Why stocks are rising when consumers expect the opposite?

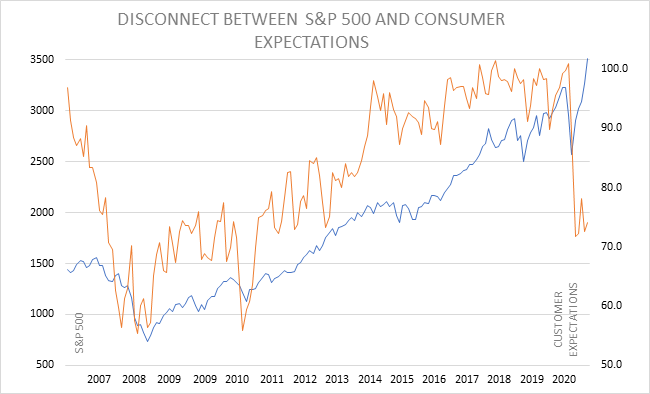

Today's situation in the US market is quite unusual. On the one hand shares do not stop rising and registering new and new peaks. On the other hand are the consumer expectations, which have not been so negative for a long time and have not differed so much from the direction of the stock markets for a long time. What's really going on?

It all started after the beginning of the coronacrisis in March this year, when consumer expectations about the economy deteriorated sharply. In the next months, they became even more pessimistic, taking into account the epidemic spread, the unpopular measures by governments around the world and forecasts for a slower recovery and a global crisis.

It seems that the direction on the stock market is totally disconnected from consumer expectations. While consumers are skeptical, the S&P 500 stock index (the value of which is determined by the 500 largest American companies) reached record levels, and the upward movement continues today.

The situation is historically unusual and the gap between consumers and stocks will close at some point. The question is how and when.

Consumer expectetion vs. S&P 500

The University of Michigan's Consumer Expectations Index shows the economic health of the US economy through the eyes of the consumers. Its monthly calculations include 5 basic questions about personal finances, business environment and attitudes for new purchases.

Since the beginning of the year, consumer confidence in the United States has declined by 25.75%.

The S&P 500 includes the 500 largest US companies by market capitalization. The weight of the companies in the index is calculated by their market capitalization. The market capitalization of a company is equal to the total value of all its shares.

From the beginning of the year until today, the return of S&P 500 is 8.58%.

The Consumer Expectations Index and S&P 500 are used by market participants as indicators of the overall state of the US economy. As can be seen on the following graph, their values move in the same direction most of the time:

Source: Yahoo Finance, University of Michigan

What is the reason for the disconnect?

As we have specified, the weights of the companies in the S&P 500 are not weighed equally, but according to their market capitalization. This provides more weight for larger companies at the expense of smaller ones.

For this reason, the shares of technology companies have greatest impact on the value of the S&P 500, because their weight in the index is 27.5%. Therefore, the strong performance of technology sector in the months of the coronacrisis has a major contribution to the overall rise of S&P 500.

| S&P 500 Sector | Index weigh as of June 30, 2020 |

| Information technology | 27.50% |

| Health care | 14.60% |

| Consumer discretionary | 10.80% |

| Communication services | 10.8% |

| Financial | 10.10% |

| Industrials | 8.00% |

| Consumer Staples | 7.00% |

| Utilities | 3.10% |

| Real estate | 2.80% |

| Energy | 2.80% |

| Materials | 2.50% |

Source: S&P Global

The main reason technology companies perform so well is the US Federal Reserve, which on March 23 launched a $750 billion loan programs to US companies as a key measure against the slowdown of the economy. The chart shows that on the same day S&P 500 pushed from the last big bottom and began to rise:

Source: BenchMark

The Fed's program includes two approaches to stimulate companies - "Corporate Bond Purchase Program" and "ETF Purchase Program".

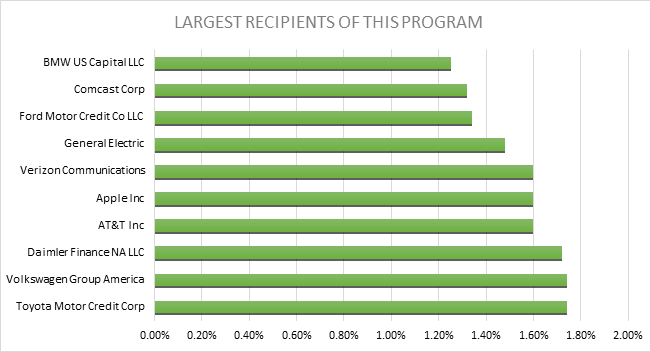

In early September, the value of corporate bonds purchased under this program was $429 million. The diagram shows the companies from which Fed has purchased the most corporate bonds:

Source: Investopedia

What surprised many investors was the Fed's decision to purchase exchange-traded funds (ETFs). This happens for a first time in Fed history. The total value of the ETFs purchased in early September exceeded $7 billion, of which $5 billion went to the following five ETFs:

| ETF name | Value |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | $1.7 billion |

| Vanguard Short-Term Corporate Bond ETF | $1.3 billion |

| Vanguard Intermediate-Term Corporate Bond ETF | $1.0 billion |

| iShares Short-Term Corporate Bond ETF | $608 million |

| SPDR Barclays High Yield Bond ETF | $412 million |

Source: Investopedia

What can happen next?

Historically, the situation at the moment is unusual, as consumer expectations and stocks usually move in the same direction because of the logical connection between them. This may suggest that the values of the two indicators will converge again and begin to move more synchronously.

In general, there are two scenarios for this to happen. The first is for consumers to regain confidence in the economy and the consumer confidence index to catch up. The second scenario is for stock prices to fall and synchronize with consumer pessimism.

Which of the two scenarios will happen, however, depends largely on development of the coronacrisis in the coming months. Questions here are whether there will be a second epidemic in autumn and winter, what its strength will be, whether there will be a deepening economic slowdown or whether we will see the first signs of optimism.

Selling or buying S&P 500?

BenchMark offers trading with the most popular US stock indices, such as SPX500, US30 and NAS100. The indices are offered as CFDs on MetaTrader platform with a narrow buy/sell spread, with no commissions and real-time quotes. CFDs allow both buying and selling.

| Commissions | NO |

| Spread | from 0.5 points |

| Min. trading volume | from 0.1 index (1 lot) |

| Margin requirement | From 0.5% |

| Long/short positions | YES |

| Automatic execution | YES |

| Hedging without margin | YES |

| Stop/Limit orders restrictions | NO |

| Expert Advisors | YES, without restrictions |

| Real-time quotes | YES, completely free |