Investment in Gold or Silver - what the data can suggest?

What could you do with your money during a crisis? Which asset has the greatest potential to maintain the maximum invested value and to rise in price over time? Against the background of today's global economic uncertainty, these questions have begun to be asked more and more often.

Most market participants probably have a ready answer. If they say that it is gold, they will be quite right, because based on its historical performance, the precious metal has managed to retain its value over time, providing protection during economic crises, periods of financial uncertainty or inflation shocks.

But there is another metal that has always been in the shadow of gold and is even contemptuously called the "gold of the poor." This is silver, which, however, shouldn't be underestimated, because the facts speak in its favor.

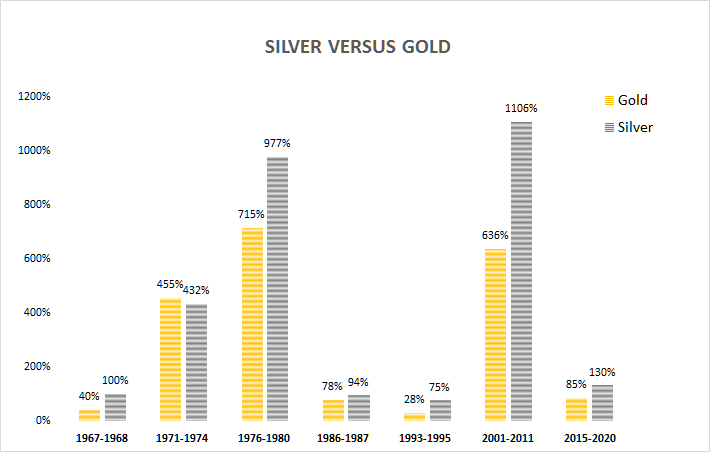

Since 1960, there have been six periods in which precious metals have risen in price over a long period of time. Silver performs better than gold in terms of profitability in 5 of the last 6 bull trends.

After the coronacrisis made the topic of gold and silver relevant again, it is very likely that we are currently in the seventh rising market.

How has silver performed so far?

From the beginning of the year gold rose by 27.84%, while silver increased its value by 50.34%. Interestingly, before the beginning of the coronacrisis, the price of silver had fallen to an 11-year low, from which it shot up and has so far achieved a growth of 130%. In comparison, gold has managed to accumulate such growth over the past 12 years.

Source: BenchMark

Silver has had several more impressive upward markets in the past lasting between one and nine years. What is more interesting is the comparison between the performance of the bull markets of the two most popular precious metals. The comparison clearly shows that silver performs far better than gold:

Source: CPM Group

The timeline of the upward markets of the two metals do not coincide completely. Usually, silver lags behind gold, but even then, it manages to perform better than gold on its own timeline.

What drives the price of silver?

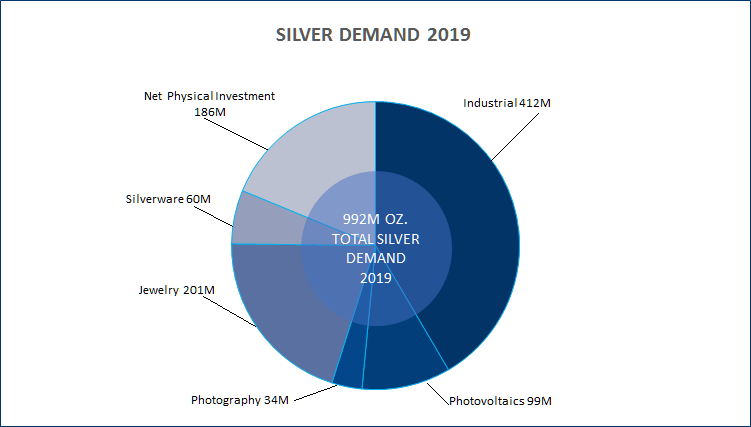

Silver is an industrial metal that is used as an important raw material in the production of a number of modern technologies and medical equipment. This is no accident, as silver has the highest electrical and thermal conductivity of all precious metals.

Apart from healthcare and electronics production, silver is also actively used in the production of renewable energy. Statistics show that nearly 100 million ounces of silver were used in the production of photovoltaic panels in 2019.

Most of the people believe that silver has only investment value, but the diagram below shows that this is not the case:

Source: Silver institute

While silver has established as one of the main safe havens for investors in times of economic crises and political uncertainty, its application in industrial and technological production continues to grow.

Silver trading

BenchMark offers gold and silver for online trading in MetaTrader platform as CFDs. Competitive spreads and no commission trading are offered on all spot metals.

Trading spot metals allows investors to take long or short positions on gold and silver as a great way to expand their portfolio. On the other hand trading spot gold is often used as a safe haven investment and used to hedge against inflation, making it a good option during times of economic uncertainty.

| Code in MetaTrader 5 | XAG_USD (Silver), XAU_USD (Gold) |

| Commissions | NO |

| Spread | $0.015 (Silver), $0.25 (Gold) |

| Min. trading volume | 50 ounces (Silver), 1 ounce (Gold) |

| Margin requirement | from 10% |

| Automatic execution | YES |

| Hedging without margin | YES |

| Long/short positions | YES |

| Stop/Limit orders restrictions | NO |

| Expert Advisors | YES, without restrictions |

| Real-time quotes | YES, completely free |