Fast recovery or prolonged recession - what's next?

Recently the global economy has entered another cycle of uncertainty and slowdown, recalling the great recession of 2008. The question we can ask today is not whether there will be an economic crisis, but rather how quickly the world will emerge from the crisis. Will the recovery be painless or is this just the beginning of one of the worst economic crisis in decades?

In search of the answers, the Conference Board's think tank conducted a large-scale study involving over 600 CEOs from leading companies around the world. The aim of the study was to establish what senior management's expectations are for global economic health and the speed of recovery.

Possible scenarios

In general, we have 4 possible scenarios under which the economy can recover after a decline in economic activity. Each of them is subject to a certain period of time, which is required for full recovery.

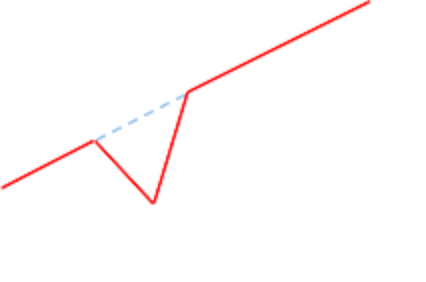

V-shaped recovery

The V-shape means a quick and lasting recovery after a sharp economic downturn. Due to its speed, this is the best scenario for overcoming the crisis. Examples of V-shaped recovery are found in the post-war recessions of 1920-21 (World War I) and 1953 (Korean War) in the United States.

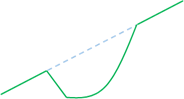

U-shaped recovery

U-shaped recoveries are observed when the economy can`t be pushed off the crisis bottom immediately, but moves close to it for a period of several consecutive quarters. We have examples of a U-shaped recovery after the oil crisis and the collapse of the stock markets in 1973-75 and after the recession of 1990-91 in the United States.

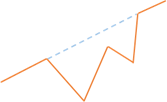

W-shaped recovery

The W-shaped pattern is observed when the economy goes from a recession to a recovery phase and then back into a new recession. This is the most insidious model, as a short recovery usually entices investors to return to the markets too early. The United States experienced a W-shaped recovery in the early 1980s. From January to July 1980, the economy entered a recession, after which it began to recover for almost a year before turning into a second recession in 1981-1982.

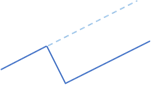

L-shaped recovery

This model is characterized by consistently high unemployment, slow return on investment activity and slow economic growth. The L-shaped recovery is associated with some of the worst economic episodes in history, such as the Great Depression of the 1930s - the longest and most severe recession of the last century.

*In addition to the above models, there are others, such as the K-shaped recovery, in which different sectors of the economy recover at different times. However, Conference Board study cover only those four models.

What does the study show?

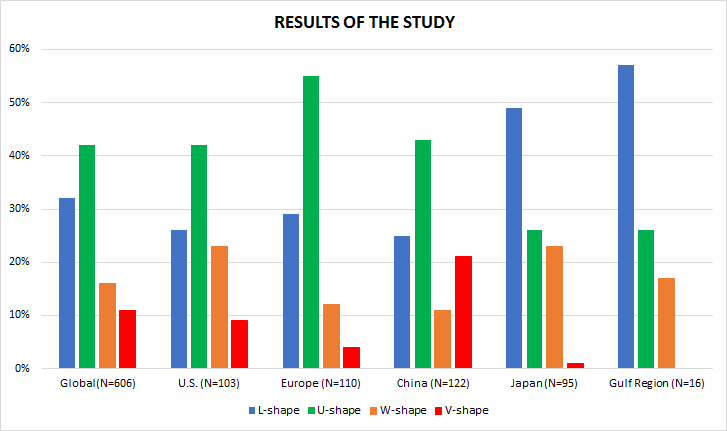

The answers obtained during the study vary due to geography, cultural differences, the health of different countries and industries. It is very likely that economies in different parts of the world to recover at different speeds and time.

To date, the mood in China is the most optimistic. Right on the opposite pole is the mood in the Persian Gulf, where CEOs surveyed are most pessimistic and expect an L-shaped recovery.

Optimism in China is mainly due to the realized economic growth in the second quarter of 2020, something that no other of the world's leading economies has managed to do so far. The pessimism in the Persian Gulf is the result of the great importance of oil production in this geographical area. The slowdown in global economies is leading to lower oil consumption and demand, and hence a slower economic recovery for producers.

The United States and Europe are moderately optimistic and U-shaped recovery expectations dominate, followed by the L-shaped model.

In Japan, the mood is reversed, with the largest share of the L-shaped recovery, followed by the U-shaped model.

Just over 20% of CEOs surveyed in the United States and Japan expect a new sharp decline in economic activity - W-shaped recovery.

The following diagram summarizes the survey data in each of the regions. The number "N" corresponds to the number of surveyed CEOs:

Source: The Conference Board

What can we expect?

The pace of economic recovery depends largely on the rate and extent of coronavirus spread in the coming months. We know too little about the virus at the moment, and the world is not so close to mass-producing a vaccine or medicine, despite encouraging signals from China, US and Britain.

However, in the event of a recent breakthrough, economies will loosen the grip of anti-epidemic measures and this will have a positive economic effect and it is even possible to see a V-shaped recovery.

The worst-case scenario involves a combination of a large-scale second wave of the virus and a delay in pharmaceutical companies research, which is likely to lead to L or W-shaped recovery.

This publication is not prepared according to the rules for preparation of investment research. The information provided is not and should not be considered as a recommendation, advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy or be taken as a guarantee for future performance. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after the publication of the analysis or strategy. Trading with financial instruments carries risk and can lead to both profits and losses.