How much money do you need to start trading?

One of the most important questions that all beginner traders are interested in is how much money they need to start trading. There is no exact answer to this question because it all depends on the individuality of each trader, his goals, and financial capabilities.

However, the amount should correspond to our comfort zone - the one in which we feel good emotionally. In order to be able to achieve maximum results and to be able to minimize the psychological burden, it is important to feel comfortable while trading.

In the following lines, will be pointed out some important factors that must be taken into account when determining the amount of funds for trading on the financial markets.

How useful is trading with a demo account?

Demo accounts undoubtedly have their usefulness not only for beginner traders but even for those who have more experience in the financial markets. However, it should be borne in mind that excessive trading in virtual funds can also have a negative effect.

One of the main ideas of a demo account is to provide real market conditions for beginner traders, in which they are not at risk of losing real money. The problem is that most beginner traders linger too long in demo trading, which unlocks the negative effect of demo accounts.

Subconsciously, everyone knows that this is virtual money and every deal takes beginners away from the conditions in real trading because of the psychological element. And very often, the psychology of trading can make a difference in our results.

It comes to a point where trading begins to resemble a computer game, in which good results leads to the formation of false confidence in beginners. This confidence leads to a serious difference between the expected and achieved results when the beginners start trading with real money.

Why does this effect occur?

Virtual money trading lacks the emotions, discipline, attitude, and judgment of the market, which are an integral part of real money trading. No matter how seriously a person takes demo trading, it's not possible to feel the challenges of real trading. Subconsciously, everyone knows that this is a demo account and when the virtual funds are lost, it takes one minute to open a new demo account.

How to overcome this problem?

The logical answer is to not overdo the trading on demo accounts. Opening a real account for training purposes, in which a small trading deposit is made, is the best solution.

There is no minimum for opening a real account in BenchMark. Therefore, it is better to trade with a small deposit of 100 currency units and minimum volumes than to trade on a demo account with virtual 100,000 currency units.

Even with such a small deposit in a real account, the overall behavior and approach to concluding trades changes, as there is a risk of losing real funds.

Only in this way the emotions in real trading can be felt and mastered, to build the necessary discipline, the right attitude, and adequate judgment related to risk management and selection of trades.

What results can you expect from trading on the financial markets?

Above all, you should expect realistic results. Traders are marathoners, not sprinters, so the goal of every trader is to increase the balance of the account in the long run. Traders are interested in the percentage return on investment, not their absolute value.

It is not realistic to expect that with 1000 currency units invested it is possible to make the same amount on a monthly basis in the long run, ie. 100% return per month. Such rates of return require huge risks.

With more risk and more luck, higher rates of return can only be realized in the short term. In the long run, this always leads to negative results.

The reason is that risk and return are directly proportional. This means that to achieve a higher return, a greater risk of a trade must be taken.

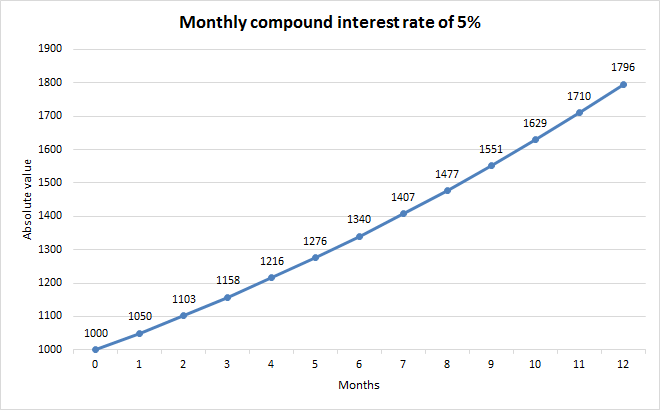

Let's look at an example with a return of 5% on a monthly basis. The chart shows a compound interest rate with a 5% monthly return. The initial value of the deposit is 1000 currency units.

The chart shows that the account balance increases from 1000 to 1796 currency units in one year. This represents an annual return of 79.6%.

| 1796-1000-796 |

| 796:1000=0.796 |

| 0.796х100=79.6% |

Trading in financial markets involves the risk of losing money and does not guarantee any sure or even positive results. The end result can be both positive or negative. Let's look at an example with different returns on a monthly basis and their impact on the account balance for one year. The initial deposit is again 1000 currency units, and the monthly returns are 2%, 4%, and -5%.

| Return per month | Account balance after one year |

| 2% | 1268 |

| 4% | 1601 |

| -5% | 557 |

After all, which amount is good for the beginners?

There is always a risk of loss when trading real money. Therefore, if we still have to give a universal answer to the question, we can say that a good initial amount is one that we can afford to lose.

This publication is not prepared according to the rules for preparation of investment research. The information provided is not and should not be considered as a recommendation, advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy or be taken as a guarantee for future performance. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after the publication of the analysis or strategy. Trading with financial instruments carries risk and can lead to both profits and losses.