Technical or Fundamental Analysis: Which one is Better?

Every beginner trader sooner or later must decide which of the two main types of analysis to use in their trading - fundamental or technical. These are the two main and time-proven techniques used by both retail traders and institutional investors.

Technical and fundamental analysis have many components that allow effective analysis and forecasting of the market movements. This is what makes the decision of which of the two analyses to be preferred difficult.

Traders often miss the opportunity to improve their results when they focus on trading one of the two analyzes and ignoring the other. However, in order to achieve an effective combination, is required to have a basic knowledge of both analyzes and a clearly defined trading strategy.

What is fundamental analysis?

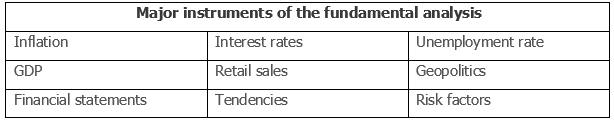

Fundamental analysis is applicable to all instruments on the financial markets, including currencies (Forex), stocks, indices, and commodities. The purpose of fundamental analysis is to find the intrinsic value of an asset or market. Finding this value occurs after all factors that influence the movement of the analyzed instrument are analyzed and evaluated - macroeconomic indicators, geopolitical risks, and others.

The fundamental factors that are analyzed are not universal, although many of the macroeconomic indicators overlap when analyzing different instruments. Each tool is influenced by certain factors that need to be analyzed. The more precisely these factors are selected and analyzed, the more accurate the calculated intrinsic value of the instrument will be.

Fundamental analysis shows what moves the price of the instrument in a certain direction, as well as what is the more likely direction of movement in the future. The decision to buy or sell is made after the intrinsic value of the instrument is compared to the market value.

This represents the optimal use of fundamental analysis in trading. This analysis is mainly used by institutional and other large investors, as its implementation requires processing and analysis of a large quantity of information. This is impossible for most small traders who use mostly technical analysis.

It was mentioned that the fundamental indicators are showing the more likely movement of the price in the future. This is useful fundamental information that can be used by smaller traders without the need to calculate the intrinsic value of an instrument. In other words, when the fundamentals of a financial instrument deteriorate, it is more likely to see a decline in the price. Conversely, when the fundamentals of an instrument improve, it is more likely to see an appreciation.

What is technical analysis?

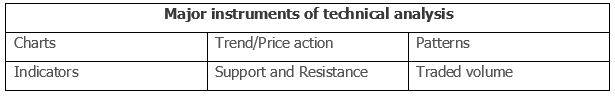

Like fundamental analysis, technical analysis is also applicable to all liquidity instruments in the financial markets. Technical analysis uses historical information from the price movement of an instrument to predict where its price is more likely to move in the future. The aim is to identify potential opportunities based on past events, which determine the more likely scenarios for future price movements. The main understanding in technical analysis is that all fundamental factors are reflected in the price movement and therefore there is no point in analyzing, forecasting, and monitoring them.

Technical analysis uses patterns, trends, support and resistance levels, indicators, traded volume, and price movement to identify potential opportunities where the probability of a successful trade is higher. The main tool of technical analysis is the chart that provides information about the historical movement of the price.

The price movement is a good indicator of the behavior of market participants in the past. The logic is that this information can be a good indicator of their future behavior in similar market situations. This has been historically proven in technical analysis models, which are repeated over time, as investors often react in a similar way in certain market situations.

Technical analysis is mainly used by short-term traders, as the effectiveness of fundamental analysis is lower over short periods, especially for trades with a horizon of several weeks, days, or hours. This does not mean that technical analysis is not used by long-term investors. They use technical analysis to find better levels for entry or exit from a position.

Advantages and disadvantages of both analyzes

Fundamental analysis allows you to analyze a huge quantity of information, which gives a very good idea of what affects the price at the moment, how long is expected to maintain this trend, and what has the potential to cause price changes in the future. By analyzing the fundament, decisions can be made to allocate financial resources to different assets to reduce risks and losses if the market sentiment change, ie. diversification.

The biggest gains are made from early positioning, so-called "smart money", which can be achieved only after a deep fundamental analysis.

Fundamental analysis requires more time to select, verify, and analyze the necessary information. This process must start over if macroeconomic changes occur that affect the performance of the asset or new important information is published. Most of the information used in fundamental analysis is widely available. An important feature of the fundamental analysis, however, is that it provides almost no information about the movement of the instrument in the short term.

In addition, evaluation models use data that are strongly influenced by a number of subjective assumptions and are rarely accurate. This makes the models difficult to apply and less accurate for periods longer than 2 years.

Technical analysis has a higher efficiency in the short term and allows much faster analysis of financial instruments than fundamental analysis. This means that technical analysis allows more assets to be analyzed, which has a positive effect on the number of trading ideas and trades.

Through the use of technical analysis, important levels on the chart can be easily identified, which are showing that the idea is wrong if the price reaches them. This allows to create trading strategies that include clearly defined risk management and to make deals that have expected potential risk and profit. In the short run, price movements are subject to many factors that cannot be fundamentally analyzed.

Market sentiment, current psychology, and short-term changes in supply and demand can be observed and analyzed through the chart. The technical analysis allows choosing a good moment for opening a position, as well as to apply trading strategies that meet the current market conditions. One look at the chart is enough to determine if the price is in trend or consolidation.

The ability to test strategies is another advantage of technical analysis, which gives a good idea of the success rate of the strategy.

Most patterns and strategies based on different theories or entry criteria depend on the trader's subjective judgment. The price can move in different directions on different timeframes, which further complicates the analysis.

Price movements show what has happened in the past, which is why their usefulness decreases more and more with the appearance of new historical information on the chart for the movement of the instrument. Most technical analysis tools have a lower success rate, which means that you need more turnover of trades to achieve greater positive results.

Which analysis is better?

Both analyzes have their advantages and disadvantages that must be taken into account. Some investors prefer to use only one of the two analyzes, but the correct use of the two analyzes in combination is more effective because minimizes the impact of their disadvantages.

The effective combination lies in the essence of the two analyzes. The fundament shows why a financial instrument is moving in a certain direction, and the technical analysis shows and studies the peculiarities of the price movement.

There are several ways to achieve an effective combination between fundamental and technical analysis:

• The chart and evaluation of the fundamental analysis must forecast the same direction.

• Countering a trend is possible when is fundamentally justified and the price movement is showing exhaustion.

• Assets for trading can be selected with fundamental analysis, and with technical analysis can be found good levels for entering in a position.

• If the chart is showing consolidation and the price is close to its intrinsic value, range strategies can be used until the fundamental factors change.

BenchMark offers free testing of trading strategies in the platforms MetaTrader 4 and 5. Strategies can be tested on a wide variety of financial instruments, including currency pairs, indices, stocks, and commodities, without the risk of losing funds and in real market conditions.

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.