How to choose the right trading strategy?

The first step to a trader's success is to develop a trading strategy. The purpose of the strategy is to give us an advantage over the market, which allows us to increase the balance of the account in the long run. But even the best strategy won`t make us successful traders if it is not suitable for us.

When choosing a strategy, it is necessary to take into account various factors that everyone should pay attention to. The most important are related to our individuality, risk tolerance, free time, and goals.

How to determine an appropriate strategy?

First of all, we must point out that the strategy is a certain criterion for going into a trade, which gives us a statistical advantage over the market. We must take into account the following features in order to be able to choose the right strategy for us:

Criteria for entering and exiting the trade

What do we need to see on the chart and should it be fundamentally supported in order to make a deal? When do we need to get out with a small loss if the price is moving against us, and when do we have to close the profit position?

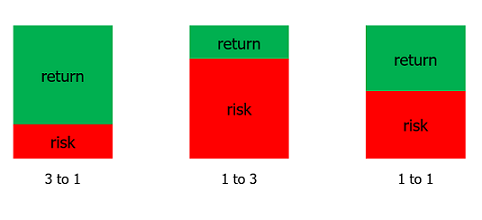

Risk-reward ratio

Everyone needs to determine the risk-reward ratio at which they will feel comfortable making deals.

Success rate of the strategy

The success rate is measured as a percentage and is found by comparing the winning trades to the total number of trades. If we have 70 winning trades and the total number is 100, then our success rate is 70%=(70:100)x100.

Risk per trade

It is a percentage of the account that shows the maximum amount we risk per trade. The standard levels for risk per trade are between 1 and 3%, maximum 5%, but they depend on the trader's risk profile.

Timeframes

The timeframe depends on the trader's preferences for a time horizon of the trades and the time he can spend tracking the charts. Bigger time frames are suitable for traders who want to make medium and long-term trades, and smaller ones for those who want to make short-term trades.

What needs to be considered?

Should be kept the following important dependencies in mind when developing your trading strategy:

Risk-reward ratio - a higher risk-reward ratio in favor of the reward leads to a lower success rate of the strategy. The opposite is also true: a higher risk-reward ratio in favor of the risk will increase the success of the strategy. The backtesting results of the strategy will show the most profitable risk-reward ratio.

Success rate of the strategy - a higher success rate means more careful selection of the trades, which reduces their number. The opposite case is observed when the success rate is lower which leads to a higher turnover of the trades. Usually, but not always, the return is higher with a significantly higher turnover on the trades, even if the success rate of the strategy is lower.

| Strategy | Strategy "A" | Strategy "B" | Strategy "C" |

| Success rate | 80% | 70% | 60% |

| Trades | 20 | 40 | 85 |

| Risk per trade | 1% | 1% | 1% |

| Net winning trades | 12 | 16 | 17 |

| Rate of return | 12%* | 16% | 17% |

*20х80%=16; 20-16=4; 16-4=12; 12*1%=12%

There are traders who prefer to have a higher success rate and traders that prefer to have a higher turnover of the trades which provide them a higher return.

Risk per trade - we can afford a greater risk per deal when the success rate of the strategy is bigger and less risk when the success rate is lower. Despite this logical dependence, it is important to take into account the risk tolerance of the trader. Some traders tend to take more risk, while others seek to minimize it.

Timeframes - larger timeframes generate fewer trading signals than smaller ones. This is due to the greater precision that the small-time periods have for the price movement. It should be borne in mind that signals from larger timeframes are more successful than those from smaller, but short time periods generate a higher turnover of trades.

Why everyone has to choose a strategy on their own?

Even if a strategy works well for someone else, it does not mean that this strategy will lead you to the same results. Each trader has his own view, interpretation, and understanding of market movements that need to be taken into account.

Test trading strategies

BenchMark offers free testing of trading strategies in the platforms MetaTrader 4 and 5. Strategies can be tested on a wide variety of financial instruments, including currency pairs, indices, stocks, and commodities, without the risk of losing funds and in real market conditions.

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.