Will oil prices continue to rise?

The past year has been extremely dynamic for the price of oil. The global pandemic has strongly affected the oil demand, as it is directly related to the economic condition of the world economy. At the same time, the main producers have managed to adapt to the crisis.

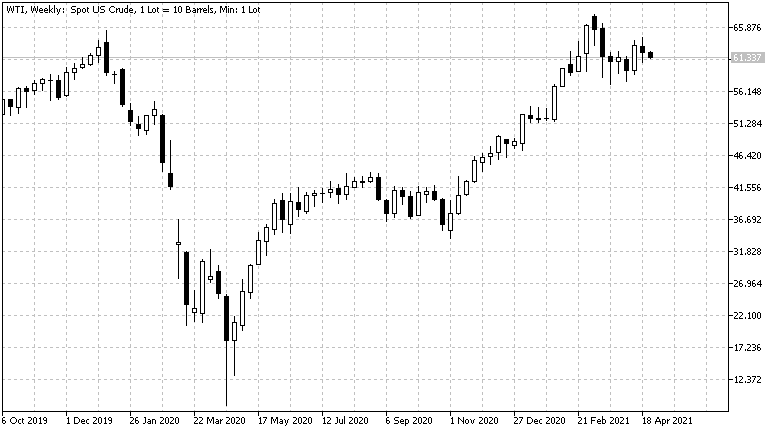

After record lows in April last year and the steady rise we saw afterwards, investors are now wondering whether global economic growth will continue to have a positive impact on oil prices.

How is the price of oil currently moving?

Due to the great importance of oil for the world economy, many factors (economic, geopolitical, crisis, military) affect its price. Controlled production and supply is the most constant factor applied by the international organization OPEC. This provides a supply that meets demand but also makes price movements more predictable.

In early 2020, there were disagreements between Russia and Saudi Arabia over the level of production, leading to a price war between the two countries. At the same time, the first restrictive measures against the pandemic followed, which further pulled investors away from the oil. As a result, the spot price of oil fell by nearly 87%.

Central banks' stimulus programs have instilled investor confidence and changed market sentiment. Optimistic expectations reversed the movement and the price of oil rose by a record 706% next year.

In early March, the price fell by 10% from the top due to various factors that affect the markets. More important are the emergence of the third wave, the blockage of the Suez Canal, the new strains of Covid-19, and the different speed of vaccination programs in the countries.

The latter two factors fall into another group of driving forces that have the potential to influence the price over a longer period of time.

What affects the price of oil?

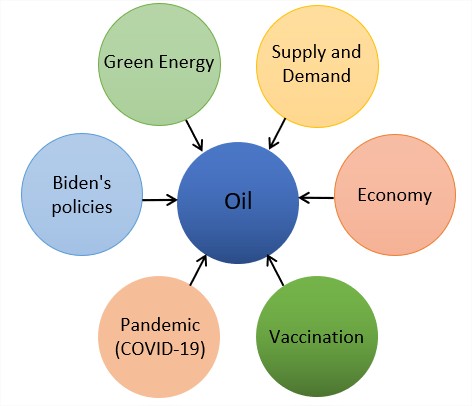

There are several important drivers that need to be monitored by investors, as they will have one or another impact on the price of oil in the future. It is important to weigh their significance and possible scenarios in order to get a better understanding of the more likely movement in the long run.

As with any other asset, an important factor is the two forces of supply and demand, but with the difference that OPEC and other large producers have the ability to regulate supply. These actions aim to ensure price stability, but at the same time can artificially raise or lower them.

We are currently seeing a reduced supply of oil and optimistic expectations of investors. This combination supports the price of oil, as markets expect an increase in demand. Positive forecasts rose late last year when several pharmaceutical companies announced they had developed a vaccine against the virus.

At present, these vaccines are used to vaccinate the population, and this continues to keep investors optimistic, but three important questions arise:

What will be the effectiveness of vaccines in the long run?

What is their effectiveness against the new strains?

How fast will the population be vaccinated?

The answers to these questions will give a better idea of the future state of the global economy. The countries will continue to experience difficulties if the long-term effectiveness of vaccines does not meet the expectations. Slow vaccination will also lead to a slower easing of restrictive measures, which will continue to have a negative impact on business development and oil consumption.

This will have a negative impact on the development of the world economy and will lead to a discrepancy between the projected and real results, both for the economic growth of the countries and for the demand for oil.

The opposite scenario is also possible, in which vaccines have the necessary effectiveness, and countries manage to vaccinate their populations faster, as do the United States and the United Kingdom. This will lead to a faster recovery of the world economy, which in turn will increase demand for oil.

Many share the view that oil extraction, processing, and use pollute the planet excessively, which is affecting climate change. One of these people is Joe Biden, the president of the United States, who wants to change the energy sector in the world's largest economy.

Biden is oriented towards green energy, which is why it envisages a reduction in federal funding for companies that deal with fossil fuels and directing funds to green companies. The president has made a number of changes so far, and his administration envisioning additional ones until the end of his term that would significantly expand the clean energy sector.

These actions will have a long-term impact on the oil industry, which will have to adapt to the coming changes that envisage expanding the use of clean energy sources. Due to the great importance of the energy sector for the economic development of the United States, these measures are not expected to be taken aggressively, but gradually.

What should traders monitor?

Price movements since the beginning of March show that investor optimism is declining, as most central banks do not anticipate a full recovery of their economies before mid-2022.

At the same time, OPEC announced that it will start increasing production and supplies in the second quarter of this year, which in the current conditions is more likely to have a negative effect on the price than a positive one.

Another factor that may suggest price movements is whether the pace of economic recovery is in line with increased supply. If economies grow faster than supply, the price will have the potential to rise, and vice versa.

A deepening of the pandemic is likely to have a negative effect on the price, even if the producing countries reduce oil production, as it will be an indicator of inability to overcome it.

Trade Oil

BenchMark offers different types of oil for online trading. The instruments are offered as CFDs on MetaTrader platforms with a narrow buy/sell spread, without commissions and real-time quotes.

Trading CFDs makes it possible to achieve a result both when the price rises (through purchases) and when it becomes cheaper (through short sales) and because they are traded on a margin, deals can be concluded without the need to pay the total value of the oil.

| Code in MetaTrader 5 | WTI, BRENT, USOIL, UKOIL |

| Commissions | NO |

| Spread | from $0.04 |

| Min. trading volume | 1 lot (10 barrels) |

| Margin requirement | from 1% |

| Automatic execution | YES |

| Hedging without margin | YES |

| Long/short positions | YES |

| Stop/Limit orders restrictions | NO |

| Expert Advisors | YES, without restrictions |

| Real-time quotes | YES, completely free |

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.