What is the difference between an investor and a trader?

Every beginner is faced with one of the most important questions concerning all of us: Do I want to be a trader or an investor? His answer is fundamental to his success of markets because speculative trading and long-term investment are extremely different approaches, which in themselves involve different methods of risk analysis and management.

The first is oriented towards long-term positions and the second towards shorter-term ones. This is where the first significant difference appears, namely the different risks facing the two groups. Another important factor, apart from time, is the method of decision-making, which forms the reasons for executing a deal.

Both approaches have both pros and cons, and in this article, we will consider the main specifics of them.

What are the main differences between the two approaches?

The main difference is between the way the two groups seek to get a positive return on the financial markets. Investors make trades that have a longer-term horizon, and traders focus on short and medium-term positions and rely on active trading.

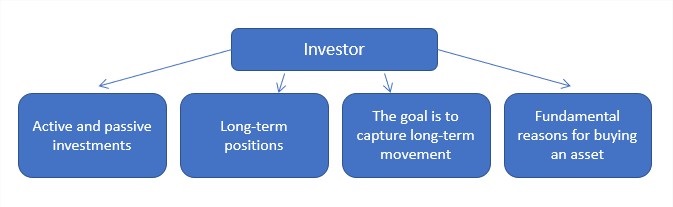

Investors are divided into two main groups - active and passive. Passives invest in instruments that follow the performance of a market, sector, geographic region, etc. Active, on the other hand, seek to secure a higher return than the market by creating their own portfolio, which includes assets that match their risk profile.

More active trading allows traders to secure potentially higher returns than investors. The reason is that in this way they have the opportunity to capture short-term and medium-term movements of financial instruments. Another plus that works in favor of traders is the possibility of short sales. Such transactions are rarely executed by investors, as on the one hand, they are riskier and on the other hand, do not meet the rational understanding of investing.

Investors need to consider the risk factors that can affect the price of assets in the long run, and traders focus on those that have an impact in the short and medium-term.

All strategies used by traders aim to capture some part of the movement of an instrument in the short term. Investors, on the other hand, aim to buy the asset at the best possible price, which is usually considered to be undervalued due to their long-term horizon of the position.

Investors rely on fundamental reasons for buying an asset and its ability to rise in price in the long run. For traders, long-term movement is not important, which is why in-depth fundamental analyzes are rarely made and technical ones are used more often. However, there are traders who use fundamental analysis and make speculative trades. This type of trading usually looks for fundamental reasons that can affect the price in the medium term.

What are their pros and cons?

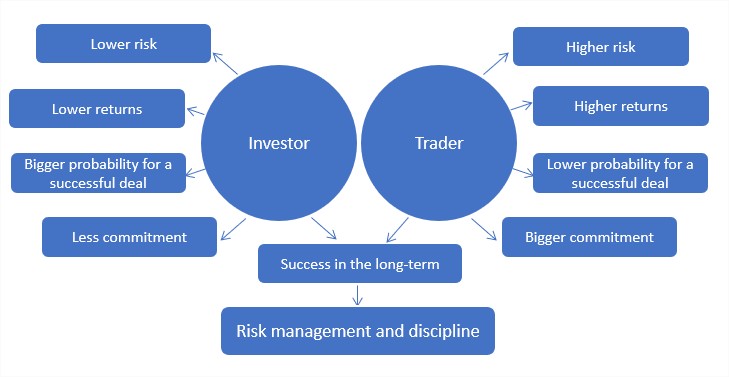

All types of deals on the financial markets are subject to risk, but due to the time period and frequency of transactions, this risk varies. A share is more likely to be more expensive after one year than the same share to be more expensive after one day or month. This makes investing less risky, as the price has a longer period of time to rise.

Active trading carries higher risks for traders but has the potential to provide higher returns. The reason is that 100-200 deals in one year can provide a net return that is greater than the equivalent of the investment if the funds are invested in one or more assets for that time period. Of course, it should be borne in mind that traders and investors cannot have a sure guarantee of the success of their investments.

A longer time horizon requires less time to monitor and manage positions. This means that the investment commitment is significantly lower than that of active trading. There are investors who monitor their positions once a week or month, but for active traders this is impossible.

Investments can also be loss-making, although the positions have a long-term horizon. Even if they are for a period of five years, this does not mean that our positions necessarily have to be profitable. On the other hand, active traders understand whether a trade is profitable or unprofitable in a significantly shorter period of time.

Short and medium-term trends, risks, and market forces often change, which provides opportunities for traders but also increases the risks in their trading. For investors, these risks are secondary, as they rarely turn into long-term ones that can affect their positions.

It is important to note that investments usually mean long-term stock purchases, and statistics show that in the long-run stock markets are moving upwards. However, there is no guarantee that you will buy shares of profitable companies, so you cannot rely on statistics blindly.

What should we keep in mind?

You can realize a return with both approaches on the financial markets, but you can also lose. The result largely depends on the knowledge and skills you have about the financial markets.

Investments require more in-depth knowledge to make the right decisions that will lead to an increase in capital over time. Otherwise, they become a long-term lottery, which rarely leads to the desired results.

Active trading does not require in-depth knowledge of the fundamental market forces that move the markets to be a successful trader. But you must have a strategy that provides you with a positive return in the long run.

Taking risks into account is an inevitable part of achieving success in both approaches.

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.