What is a split and reverse split of a stock?

Every company strives to make its securities as attractive as possible to investors. One of the main factors is the price, which has a significant psychological effect on purchasing decisions.

Manipulating the market prices is completely forbidden, but there are still two legal ways in which the company's management can change the share price, which is seen by all potential buyers.

In fact, a split or reverse split of the securities takes place. This increases or decreases their number, which leads to a change in their prices.

1. How do companies change the number of shares?

Companies can change the number of shares in two main ways. The first is called a split and leads to an increase in their number, and the second is called a reverse split and leads to their decrease. Both types of operations aim to affect the price, which makes the securities more accessible to investors.

Split of shares

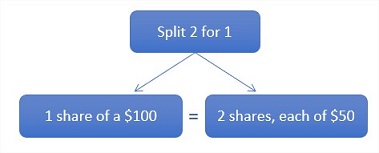

A share split is an operation by which a share is divided into several shares. For example, a split in a ratio of 2 for 1 means that 1 share will be divided into 2 separate shares. If the ratio is 4 for 1, the share will be divided into 4 shares, and if is 5 for 1 - into 5. This means that if we own one share in a company that make a split 2 for 1, after the split we will have 2 shares.

In case of a split, the share price also changes to reflect the changes in the number of securities. If we have one share, which at the time of the split in a ratio of 2 for 1 costs $100, then after the split we will have two shares, each of which will cost $50.

Reverse split

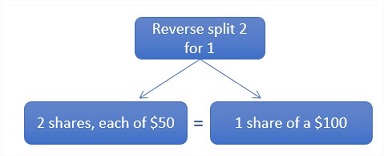

This operation is the exact opposite of the normal split, which means that several shares are combined into one share. For example, a reverse split in a 1 for 2 ratio means that 2 shares will be merged into one. If the ratio is 1 for 4, then 4 shares will be merged into one. In case we own 2 shares in a company that make a 1 for 2 reverse split, after the split, we will have 1 share.

In a reverse split, the share price also changes to reflect changes in the number of shares. If we have 2 shares that at the time of the split in a 1 for 2 ratio cost $100 each, then after the split we will have one share that will cost $200.

Although splits and reverse splits change the price and number of shares, the value of each shareholder's investment and the company's market capitalization are maintained.

2. Why the companies do split and reverse split?

Companies undertake similar operations for several main reasons in order to improve the attractiveness of shares for current and new investors.

Companies usually perform well when they have strong fundament and good growth prospects, which leads to a significant increase in their share prices. This is favorable for the current shareholders because they realize a good return on their investments, but it also creates a problem for the company's management. Quite logically, almost every shareholder who has realized a good return will want to sell the shares at some point. Higher stock prices are becoming a challenge as they make securities more inaccessible to many potential shareholders.

In addition, high prices are often associated with overvalued assets, which can create a false impression of stocks and further repel investors.

At such times, companies do splits of their shares, which lowers their price in order to keep investors' interest. The psychological effect is both in relation to the current shareholders, who increase the number of shares held and in relation to the new ones, who can acquire a share in the company at lower prices.

Not only high but also low stock prices can be a problem for the company. If the securities are traded at a lower price than the minimum required by the stock exchange, the company will be delisted. For example, if the minimum asking price on the stock exchange is $1 per share and the securities are traded for $0.50 and the company is unable to raise their price, the shares will be delisted from the stock exchange.

Cheap stocks are also a problem for large investors, who invest more capital and seek to acquire a larger stake in the company. For this reason, reverse splits are made, which increases stock prices.

Shares with a higher price seem more valuable than those with lower ones, which affects the decisions of most investors. A company whose shares are traded for $15 will look much more attractive if it makes a 1 for 10 reverse split, which will increase the value of the shares to $150.

Liquidity is another very important factor that plays a key role in companies' decisions to perform either operation. The higher the price, the fewer investors can afford to buy the shares, which reduces their liquidity. This can cause increased spreads, slippage, and sharper movements - especially in a downward direction.

3. Should we trade the splits?

Although we often witness aggressive movements after a change in the number of shares and their price, the splits themselves should not be a motive for making trades, as they do not change the company's profitability or prospects for its growth.

The leading reason for concluding a trade should always be the strategy, whether it is based on fundamental, technical, or mixed signals.

Even after a split, the practice shows that in most cases the investors keep their initial attitudes towards the company.

Which companies will make splits soon?

Two of the leading companies in their sectors have decided to change the number of their shares.

Technology company NVIDIA, which has seen a growth of nearly 100% over the past year, will undertake a 4 for 1 split on July 20, which means that each share will be divided into 4 new ones. This will be the fifth split for the company, and the good performance of the shares has increased its market capitalization to $500 billion. NVIDIA's goal is to make the shares more accessible to small investors and employees of the company, as well as to improve their liquidity.

General Electric announced that it will take a reverse slip of its shares in a ratio of 1 for 8 on August 2, which means that 8 shares will be merged into one. Like NVIDIA, General Electric's stock has also risen nearly 100 percent in the past year, but its shares remain relatively cheap compared to most Wall Street stocks. The current price is just over $13, but at the same time the company has between 6-8 times more outstanding shares than its main competitors, which does not reflect the changes in the company's structure, which were caused by the gradual sales of GE Capital.

Stock trading

BenchMark offers online trading with various stocks from the US and Europe. The securities are offered as CFDs on the MetaTrader platform with a narrow buy/sell spread, low commissions, and real-time quotes.

Trading CFDs makes it possible to achieve a result both when the price rises (through purchases) and when it becomes cheaper (through short sales) and because they are traded on a margin, deals can be concluded without the need to pay the total value of the deal.

| Commissions | $0.05/share, No min. commissions |

| Spread | from $0.01 |

| Min. trading volume | 1 share (1 lot) |

| Margin requirement | from 10% |

| Automatic execution | YES |

| Hedging without margin | YES |

| Long/short positions | YES |

| Stop/Limit orders restrictions | NO |

| Expert Advisors | YES, without restrictions |

| Real-time quotes | YES, completely free |

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.