Why is risk management important?

The main reason that fails traders, in the long run, is improper risk management. In fact, the big problem is that a significant proportion of market participants do not implement any risk management at all because they do not realize why it is so important. Others use risk management but often is inappropriate for their winning rate of the strategy.

The problem is not in the difficult understanding of risk management as a concept, but due to a misunderstanding of trading as an activity. This misunderstanding of trading reflects on the entire trading plan, including risk management.

What is trading?

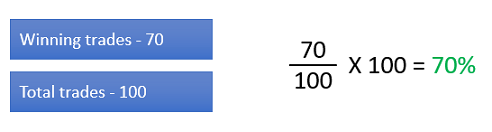

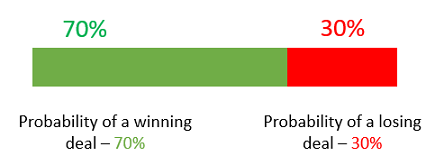

The main goal of a trader is to increase the balance of his account in the long run. However, for it to be possible, the trader must have a strategy. Each strategy has a certain success rate, which is the ratio between the winning trades and the total number of trades.

This ratio shows us something very important - not every deal will be successful.

What exactly is risk management?

Risk management in trading is necessary because there is a possibility of concluding a losing trade.

The probability to make a losing trade is understood by the success of the strategy, which provides us with the necessary information about the risk we can expect in trading.

The higher the success rate of the strategy, the greater risk we can have on each deal. The lower success rate of the strategy suggests that we need to have a lower risk on each trade.

This means that the main goal of risk management is to protect our capital when we make a losing trade, which will happen at some point, as the success of the strategy confirms it, ie. success shows that not every deal will be a winning trade.

The question is, "What risk should we have per trade?" Risk is the maximum amount we are willing to risk per trade and represents a percentage of the account balance.

Accepted risk levels are between 1-3% per trade, maximum 5% for more aggressive traders.

What does the lack of risk management lead to?

One of the biggest psychological traps for traders is that they try to avoid the losing trades, which leads to trades that do not have stops to limit the loss. With this approach, there is no pre-set risk per trade, so the overall risk management is not good.

Because of the high risk in margin trading, only one deal can lead to big losses if there is no risk management.

In addition, this approach encourages loss tolerance and rapid collection of profits. Most traders in this way of trading tend to keep large losses until the position goes to "0" or goes to a small profit, but do not have the same tolerance for profits to be allowed to develop. Profits are collected quickly and losing positions are left so as not to close at a loss, but there comes a time when the price does not return to the same levels of opening the position, which leads to large losses.

Another common mistake is to think that financial markets are a place where one can get rich quickly. This misconception leads to making trades with much larger volumes than the deposit suggests.

What type of risk management should we use?

First of all, risk management must meet your risk tolerance. If you are a more conservative trader is better to have a lower risk per trade, as higher risk is suitable for more aggressive traders.

It is very important that your risk management matches the success rate of your strategy. Even if you want to be more aggressive with a 3% risk per trade if the success of your strategy is 50-55% (1:1 profit/loss ratio), this risk is not suitable for this strategy at this level of success rate. For this reason, it will be better to look for a strategy with a higher success rate, which allows a higher risk per trade.

The ability to adhere to long-term risk management is another important factor to consider.

Currency trading

BenchMark offers more than 70 currency pairs for online trading. Forex trading is offered as contracts for difference (CFDs) in the MetaTrader platform with a narrow spread, buy/sell, starting from 0.1 pips, without commissions, and free quotes in real-time

Currency pair trading makes it possible to achieve a result both when the price rises (through purchases) and when it depreciates (through short sales) and because currencies are traded on a margin, trades can be made without having to pay their full value.

| Commissions | No |

| Spread | from 0.1 pip |

| Min. trading volume | 1000 currency units (0.01 lot) |

| Margin requirement | from 0.25% |

| Automatic execution | Yes |

| Hedging without margin | Yes |

| Long/Short positions | Yes |

| Stop/Limit orders restrictions | No |

| Expert Advisors | Yes |

| Real-time quotes | Yes |

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.