Why do central banks target 2% inflation per year?

One of the main goals of the leading central banks, even explicitly written in their statutes, is to maintain price stability. Some of them indicate the exact rate of annual inflation that they seek to achieve, while others specify a range as it allows greater flexibility for the bank.

Many attribute inflation to the devaluation of money and its negative effect on consumer savings. It is quite logical then to ask the question "Why does the central bank strive to keep low inflation?".

Inflation and central banks

Two important terms need to be clarified - inflation and deflation. Inflation is the general rise in prices in an economy. Deflation means lowering the overall price level.

Making this distinction, one would think that deflation is better for the economy and consumers because prices are declining. In fact, this is not the case at all, at least in terms of the economy. The danger of deflation is the main reason why central banks strive to keep low inflation.

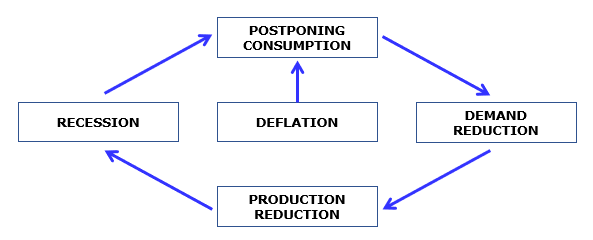

The reason is that deflation leads to a slowdown in economic growth and a spiraling circle, which can have serious consequences for the economy. How exactly? When consumers expect lower prices, ie. deflation, the likelihood of delaying their desired purchases increases because they know they would pay a lower price in the future. This leads to fewer purchases of goods and services today, which reduces what is produced and consumed in the economy. The lower demand from consumers causes a decrease in the production of companies and represents a further decrease in activity. When organizations produce less, they need less labor, and this leads to layoffs. This whole process leads to a slowdown in the economy and expectations of a recession, which makes people save even more and consume less, and companies continue to reduce their supply as they expect less demand. This is the vicious circle that the economy is likely to enter when deflation occurs.

Central bankers believe that 2%, which is the most commonly set inflation target, is far enough away to reduce the risk of deflation, but also low enough so that rising prices do not have a negative impact on the economy. In addition, keeping inflation at such low levels, when successful, encourages organizations to offer more goods and services to consumers. The reason is that the higher the price, the more goods and services companies tend to offer. This dependence is the opposite for consumers - the lower the price, the more goods and services they tend to buy (does not apply to all products).

Central bank instruments

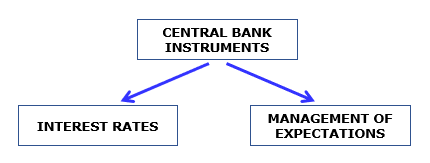

The central bank has many tools to direct inflation in the desired direction. The two most important are the interest rate and the management of expectations, to which few investors pay attention.

Interest rates

When inflation starts to exceed two percent, what central banks can do is raise the key interest rate. The opposite is also true, when inflation is close to 0%, the central bank can lower the interest rate to stimulate demand from consumers and businesses.

Interest rates are not used so directly, because first of all bankers have to assess what will be the impact on economic activity. Inflation, which comes from rising commodity prices and supply chain problems, as is currently the case, will have a much more sustainable impact and less response to interest rate hikes. On the other hand, inflation, which is caused by an increase in aggregate demand in the economy, can be more easily slowed down by rising interest rates.

In addition, attention must be paid to inflation expectations, because raising interest rates does not immediately affect economic activity. If inflation is temporary and the central bank raises interest rates, higher interest rates may hinder economic development.

Management of expectations

Those of you who have been monitoring the markets for the past year and a half have probably heard that the Federal Reserve expects inflation to be temporary at the moment. This is a position that the bank has maintained for more than a year, while inflation continues to rise today. The following questions arise, if inflation is temporary, why does it last so long, how long will it last and why is it still increasing? Part of the answer is the reasons given above in the text, but here it is more important to understand what exactly the Federal Reserve is doing.

Through these actions, the central bank seeks to manage the expectations of both investors and ordinary consumers. If more producers believe that inflation is temporary, they will not rush to raise prices. The situation will be completely different if the Federal Reserve announces that it expects high inflation of 20-25% in the coming years. In this case, many organizations will begin to aggressively raise their prices, and employees and unions to demand higher wages.

By openly stating its inflation target of 2% per year, a central bank gives guidelines to consumers and producers in the economy what price increases can be expected, which allows the bank to more easily achieve the set goals.

Inflation and currency rates

Inflation is usually associated with increased growth and good economic performance. Higher inflation leads to higher interest rates, which can make the country's currency more expensive. The opposite is also true, lower inflation leads to lower interest rates and cheaper currency.

Currency trading

BenchMark offers more than 70 currency pairs for online trading. Forex trading is offered as contracts for difference (CFDs) in the MetaTrader platform with a narrow spread, buy/sell, starting from 0.1 pips, without commissions, and free quotes in real-time

Currency pair trading makes it possible to achieve a result both when the price rises (through purchases) and when it depreciates (through short sales) and because currencies are traded on a margin, trades can be made without having to pay their full value.

| Commissions | No |

| Spread | from 0.1 pip |

| Min. trading volume | 1000 currency units (0.01 lot) |

| Margin requirement | from 0.25% |

| Automatic execution | Yes |

| Hedging without margin | Yes |

| Long/Short positions | Yes |

| Stop/Limit orders restrictions | No |

| Expert Advisors | Yes |

| Real-time quotes | Yes |

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.