Fed and inflation: What can we expect?

Contrary to the initial expectations of the Federal Reserve, the new forecasts are inflation to retain for a longer period of time. This also acknowledged the President of Fed Jerome Powell and said that there are different sources of risk related to prices.

Economic uncertainty continues to be a fact, but Fed has announced that it will use all necessary tools to restrict inflation. This places the central bank in a specific situation, and its actions will affect the movements of the stock markets and the US dollar. The question is what will be the impact?

Why does inflation continue to be high?

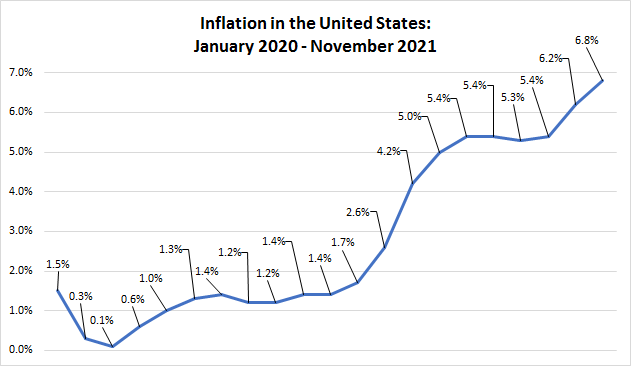

Inflation in the United States reached 6.8% on an annual basis in November 2021, which retained the value on a 30-years high.

QE and Government stimulus

The Federal Reserve has announced that a gradual reduction in quantitative reliefs, which is already happening, and the program itself is expected to be completed in the first half of 2022. These actions were taken by the bank to limit inflation, but this puts the federal reserve in a specific situation. There is a continuing price increase and there are a number of obstacles that could have an effect on the economic recovery.

Even gradually declining, the Fed's quantitative program has an impact on rising prices. The QE of the Fed and the major support package for the US government contributed to the multiplication of money and rising prices in the country.

Supply chains

Problems related to supply chains, including the increase in transport prices, delays in supply, and shortages of some major components are another important factor that affects the price rising for end-users.

The US is the largest economy in the world, but at the same time is the largest importer of foreign goods and services. In addition, the US economy is the second-largest exporter in the world after China. Because of the big foreign trade that the country has, the problems with supply chains have a major impact on inflation.

Less supply

The drastic measures taken by the countries, including the US, in order to limit the spread of the virus changed the expectations of most businesses. Much of the manufacturers have reduced their production, which has affected prices as demand remained higher than expected. The result is rising prices, and Jerome Powell commented that this pressure will continue until the balance is restored between the two forces - supply and demand, but it is still early Fed to take action.

Currently, the economic recovery continues to increase demand while supply remains lower and grows at a slower pace, which is reflected in rising prices.

Impact on markets

A significantly larger part of the investment capital was directed to the stock markets since the start of the pandemic, which sent the indices to record hights.

Two are the main reasons why investors preferred the shares in recent months. Low-interest rates lower bond yields and other financial assets that provide fixed income, making those assets less attractive for investment. The other reason is the support of the Fed and the US government to the economy. Fed and the government actions significantly increased investors' optimism both for the recovery of the economy and the future profits of companies that would support their stock prices.

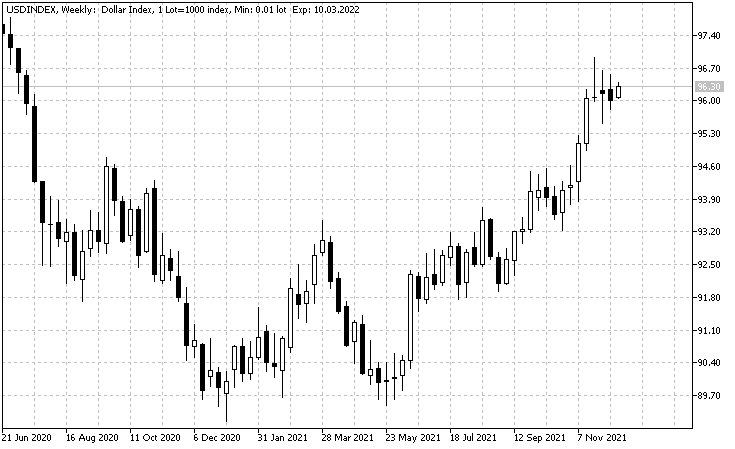

The index that measures the US dollar performance turned the direction of movement at the end of May 2021 and since then has been in an upward trend.

The US dollar recorded appreciation in recent months because the US economy is recovering faster than some of the other major economies. This in turn increased the expectations for termination of QE and for faster tightening of monetary policy. Because of this and the good performance of stock markets and the lack of more serious anti-epidemic constraints, such as in Europe, many of the investors have chosen to keep part of their capital in US dollars and US assets. Increasing yields of 10-year government bonds is another reason that increased demand for dollars.

What are the expectations?

Inflation and interest

The Chairman of Fed Jerome Powell said the central bank remains committed to maintaining price stability and will use monetary policy instruments to prevent high inflation from retaining for a longer period of time. The Central Bank can actually apply an aggressive monetary policy to delay inflation, but this specific situation does not allow such hasty actions.

Lifting interest rates will not have an impact and will not solve the available supply chain problems, and may even aggravate them because it will increase business costs, both with new bank loans and the payment of bond loans. However, gradual interest lifting can lead to a balance between demand and supply and to a positive impact on reducing inflation. The reason is that higher interest rates usually lead to demand reduction. Currently, the Federal Reserve said it would increase the pace to end the quantitative program, and 3 raising interest rates were expected in 2022. Reducing quantitative benefits will end their impact on price rises, and interest rates are related to open market operations * that lead to a reduction in money supply in the economy and price growth.

*In this type of operations, the Central Bank sells government securities to other major institutions, especially large banks. The result is that the money in the economy is decreasing, as the institutions have to pay the securities to the Central Bank. Less money in the economy means that banks have fewer credit funds and the companies have less capital to invest in expansion.

The new Fed inflation forecasts are that rising prices will decrease in the first half of next year when a better balance between demand and supply is expected. Bankers, however, warn that new virus variants continue to be a risk to prices as they have a negative impact on supply, supply chains, and economic development. Here is the difference compared to the Bank's previous forecasts - Jerome Powell said that is possible the increase in prices to continue for a longer period of time if new risks retain their negative impact on economic prospects.

Markets

Inflation and low-interest rates are obviously supporting stock markets, which we can see from their returns over the past 2 years. However, raising interest will make bonds and other financial assets that have fixed yields or income, and often a lower risk of the shares more attractive to investors. For this reason, stock market sales are possible because a part of the capital will be redirected to other financial instruments. However, the good performance of the economies is also related to the good performance of companies that increase their profits, which leads to an appreciation of their shares and rising stock markets. Even when the interest rates hikes begin, the expectations are stock markets to continue their upward movement, but at a slower pace than that, we saw from March 2020 to this day. The slower growth will be due to most opportunities that have market participants to invest.

Higher interest rates will make the US dollar more attractive for investments than other major currencies. Investors will be able to receive higher interest rates from their US dollar deposits and higher returns from bonds and other assets that offer fixed payments related to interest rates. Traders will get higher swaps from their open positions in which the US dollar is the long currency when are trading the US dollar against some of the other major currencies. This is the reason why we are seeing the dollar's appreciation in recent months, as investors already direct part of their capital to the currency. The current situation and expectations imply the appreciation of the US dollar to continue next year.

Currency trading

BenchMark offers more than 70 currency pairs for online trading. Forex trading is offered as contracts for difference (CFDs) in the MetaTrader platform with a narrow spread, buy/sell, starting from 0.1 pips, without commissions, and free quotes in real-time

Currency pair trading makes it possible to achieve a result both when the price rises (through purchases) and when it depreciates (through short sales) and because currencies are traded on a margin, trades can be made without having to pay their full value.

| Commissions | No |

| Spread | from 0.1 pip |

| Min. trading volume | 1000 currency units (0.01 lot) |

| Margin requirement | from 0.25% |

| Automatic execution | Yes |

| Hedging without margin | Yes |

| Long/Short positions | Yes |

| Stop/Limit orders restrictions | No |

| Expert Advisors | Yes |

| Real-time quotes | Yes |

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.