Divergences: More efficient signals from oscillators

Divergences are more efficient signals from oscillators and this style of trading is preferred by many traders, as it has the potential to provide a higher success rate than the classic zones of overbought and sold.

Divergence is divided into two types - normal and hidden. Normal divergence signals a possible reversal of the trend and hidden divergence signals that a continuation is possible.

What is divergence?

Divergence is the discrepancy between the movement of the price and the movement of the oscillator. This discrepancy is measured through local maximums and minimums - depending on whether normal or hidden divergence is sought.

Normal divergence

Normal divergence gives us a signal that a reversal of the trend is possible. In an upward trend, it is measured through local maximums, and in a downward trend it is measured through local minimums.

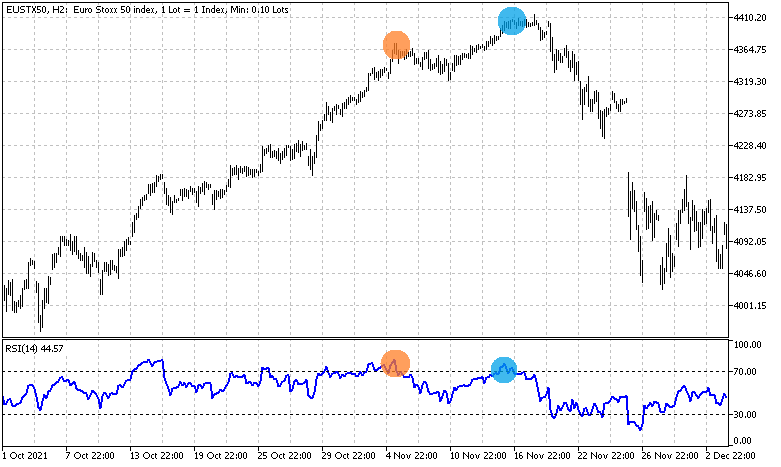

Normal divergence in an upward trend

In the orange dots, we see that the price and the oscillator make a series of higher local maximums. At the blue point, however, the price makes a higher local maximum and the oscillator makes a lower local maximum. This is the normal divergence in an upward trend, which gives us a signal that is a possible reversal of the trend.

Normal divergence in an upward trend - EUSTX50

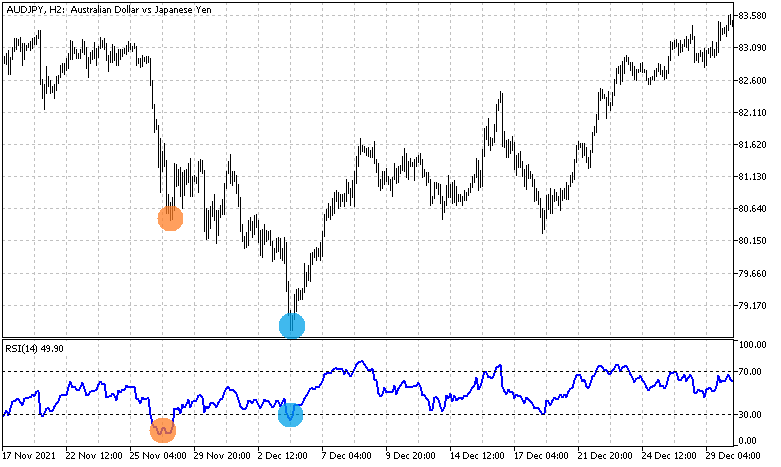

Normal divergence in a downward trend

The price and the oscillator make a series of lower local minimums, which we can see in the orange dots. In the blue dot, however, we see that the price makes the local minimum lower and the oscillator makes the local minimum higher. This is the normal divergence in a downward trend, which gives us a signal that an upward movement is possible.

Normal divergence in a downward trend - AUDJPY

Hidden divergence

The hidden divergence gives us a signal that a continuation of the trend is possible. In an uptrend, it is measured through local minimums, and in a downward trend, it is measured through local maximums.

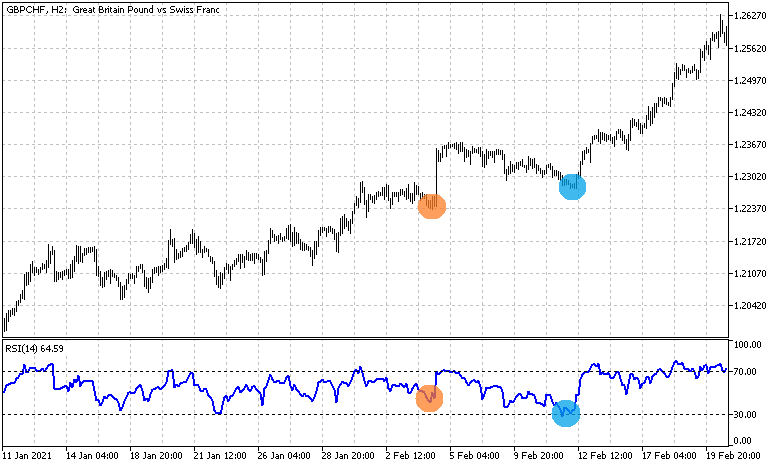

Hidden divergence in an upward trend

In the orange dots, we see that the price and the oscillator make a series of higher local minimums. At the blue point, however, the price makes the local minimum higher and the oscillator makes the local minimum lower. This is the hidden divergence in an upward trend, which gives us a signal that is possible trend to continue.

Hidden divergence in an upward trend - GBPCHF

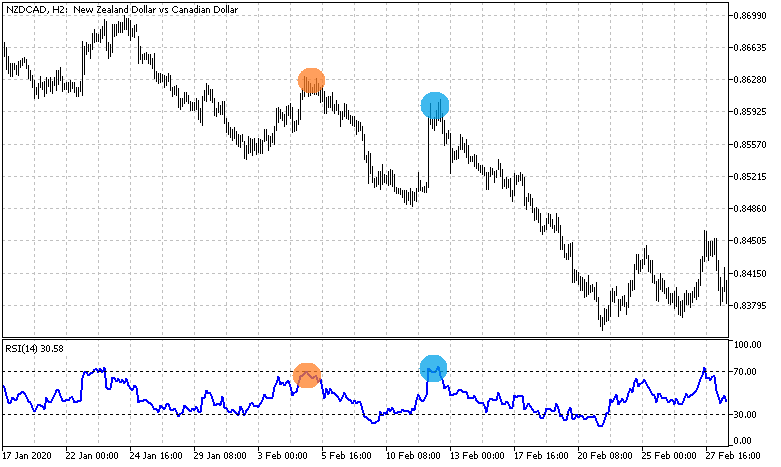

Hidden divergence in a downward trend

In the example, we see that the price and the oscillator register a series of lower local maximums in the orange dots. At the blue point, however, the price registers a lower local maximum, and the oscillator makes a higher local maximum. This is exactly the hidden divergence in a downward trend, which gives us a signal that is possible trend to continue.

Hidden divergence in a downward trend - NZDCAD

What do we need to know about divergences?

There are a few more important things about divergences that every trader should keep in mind.

• Hidden divergence has the potential to provide a higher success rate than normal divergence. The reason is that it gives signals that are in the direction of the trend.

• Divergence gives us a signal that a movement is possible, but not when that movement is expected to begin. For this reason, it is desirable to use additional signals when trading divergences.

• Divergence does not signal how big will be the expected movement - this means that additional criteria are needed to exit the deal.

Currency trading

BenchMark offers more than 70 currency pairs for online trading. Forex trading is offered as contracts for difference (CFDs) in the MetaTrader platform with a narrow spread, buy/sell, starting from 0.1 pips, without commissions, and free quotes in real-time

Currency pair trading makes it possible to achieve a result both when the price rises (through purchases) and when it depreciates (through short sales) and because currencies are traded on a margin, trades can be made without having to pay their full value.

| Commissions | No |

| Spread | from 0.1 pip |

| Min. trading volume | 1000 currency units (0.01 lot) |

| Margin requirement | from 0.25% |

| Automatic execution | Yes |

| Hedging without margin | Yes |

| Long/Short positions | Yes |

| Stop/Limit orders restrictions | No |

| Expert Advisors | Yes |

| Real-time quotes | Yes |

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.