What to expect from the British Pound after Brexit?

It is a well-known fact that the Pound is one of the most traded and preferred currencies by traders. And now one of the most important questions for market participants is what will be the future movement of the Pound after Brexit.

The value of each currency is directly related and dependent on the economic condition of the country, the policy of the central bank, and the government, which together form the fundamental environment. The market interprets the available information, which leads to the valuation of the currency at a given time, but future movements are dictated by the expectations of market participants for the development of the economy.

There are several important dependencies related to the British economy, on which depends the movement of the British currency in the medium and long term.

The British Pound and Brexit

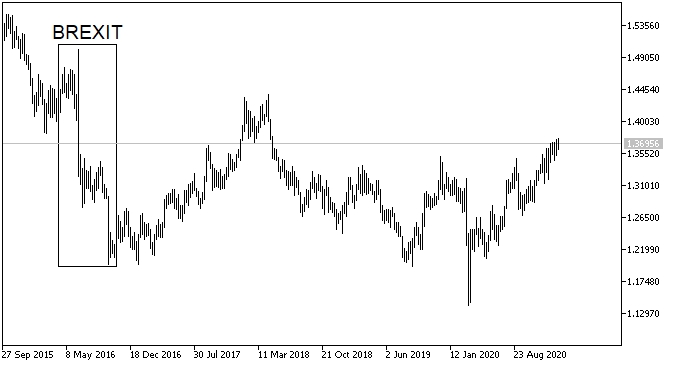

The British Pound was subject to mass sales in June 2016, after a referendum in the UK on leaving the European Union, which passed with 51.9%.

The currency lost more than 20% against the US dollar and reached record lows over the next four months, which were due to increased economic uncertainty in the UK. Investors and traders had to adapt to the new reality, in which price movements in the currency were dictated by the development of negotiations between the European Union and the United Kingdom, rather than by the actions of the central bank or the economic situation in the country.

Volatility increased significantly, which further made the analysis more difficult and made riskier the Pound trading. These market conditions remained until the last moment, as the two parties concluded a deal on December 24, 2020, one week before the deadline - December 31, 2020.

The deal reduced the risks to some extent for the economy, which again brought forward the actions of the central bank, the country's economic situation, and government policy as key factors in the movement of the Pound.

What is the movement of the British Pound at the moment?

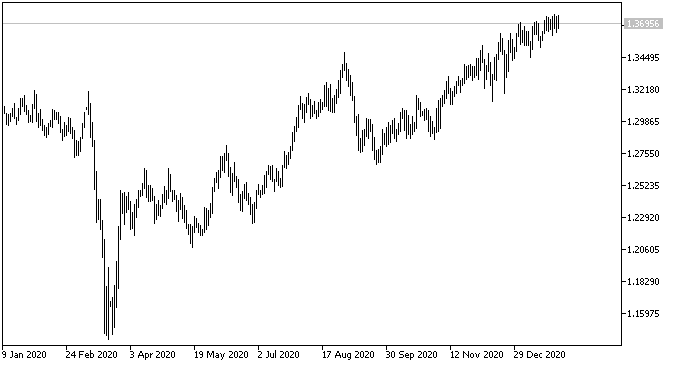

Currently, the price is on an upward trend since mid-March 2020 and managed to register an appreciation against the US dollar by nearly 20%.

The UK is one of the largest and most developed economies in the world, which is a premise for a more expensive currency. Many investors took advantage of the new record lows in the Pound, which were reached during the first wave of the coronavirus, to make long-term investments in the currency. Optimistic views that a Brexit deal will be reached are another factor that has led to a rise of the Pound over the past year, as many investors thought the currency was too cheap compared to its historical levels.

There is also the opposite view that the pound is too expensive at the moment because the UK economy continues to be one of the hardest hit by the spread of the virus. At the end of 2020, a new strain was discovered, which led to a new tightening of anti-epidemic measures and worsening prospects for economic growth in the coming months.

What are the expectations for the movement in the medium-term?

The movement of the Pound in the coming months will be dictated by the government's results in the fight against the coronavirus. Limiting the pandemic will allow the measures to be lifted, which will lead to a resumption of economic growth in the UK and an appreciation of the currency.

The Bank of England has signaled that it will conduct a monetary policy that stimulates the economy to its full recovery, and the government's position is that it will continue to implement support programs for businesses and households until the restrictive measures are lifted. These actions support the price of the Pound, which has historically always been more expensive than other major currencies. But on the other hand, there is also the possibility to be preferred a cheaper Pound by the Bank of England to stimulate Britain's foreign trade after leaving the European Union.

In the long run, the movement of the Pound will depend mainly on the economic results of the United Kingdom, which have been achieved since leaving the European Union. These results will be closely monitored by investors and compared with the results achieved during the membership in the European Union. Better results will have a positive impact on the value of the currency, and weaker ones will have a negative one.

Currency trading

BenchMark offers more than 70 currency pairs for online trading. Forex trading is offered as contracts for difference (CFDs) in the MetaTrader platform with a narrow spread, buy/sell, starting from 0.1 pips, without commissions, and free quotes in real-time

Currency pair trading makes it possible to achieve a result both when the price rises (through purchases) and when it depreciates (through short sales) and because currencies are traded on a margin, trades can be made without having to pay their full value.

| Commissions | No |

| Spread | from 0.1 pip |

| Min. trading volume | 1000 currency units (0.01 lot) |

| Margin requirement | from 0.25% |

| Automatic execution | Yes |

| Hedging without margin | Yes |

| Long/Short positions | Yes |

| Stop/Limit orders restrictions | No |

| Expert Advisors | Yes |

| Real-time quotes | Yes |

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.