Forex or stocks: What to trade?

Every beginner asks themselves the question "Which instruments do I start trading?". Financial markets provide a big choice and many opportunities for traders, but each market has its own specifics that must be taken into account.

Success on the financial markets requires an understanding of the specifics of each asset in order to be able to implement appropriate strategies and proper risk management.

Currency and stock trading is among the most popular and preferred in the financial markets, which is why most traders turn to these instruments.

1. Movements of the currencies and the shares

The main forces behind price movements are supply and demand, which, however, are influenced by various factors.

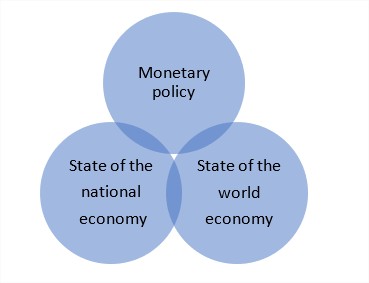

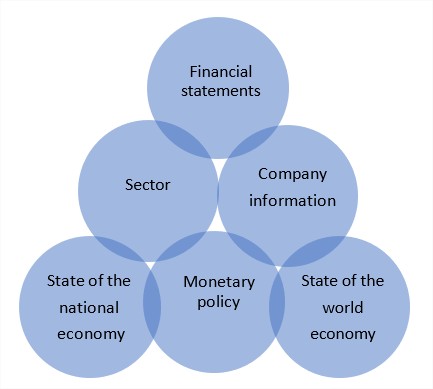

The actions of the central bank and the state of the national and world economy have the greatest influence on the movement of currencies.

Various economic indicators give us clarity about economic growth in a country and the state of the economy. Such indicators are interest rates, inflation, unemployment, and GDP.

The state of the world economy can cause the movement of capital from one currency to another. In the face of uncertainty, market participants prefer safe-haven currencies such as the US dollar, the Japanese yen, and the Swiss franc.

The actions of the central bank also have a great influence on the price movement of a currency. Currencies appreciate when investors have confidence in the actions of the central bank, and vice versa, depreciate in the absence of confidence in the bank's policy.

In addition to the three factors already listed - the company's financial statements, the sector, and information related to the company, which can be both positive and negative, have an additional influence on the share prices.

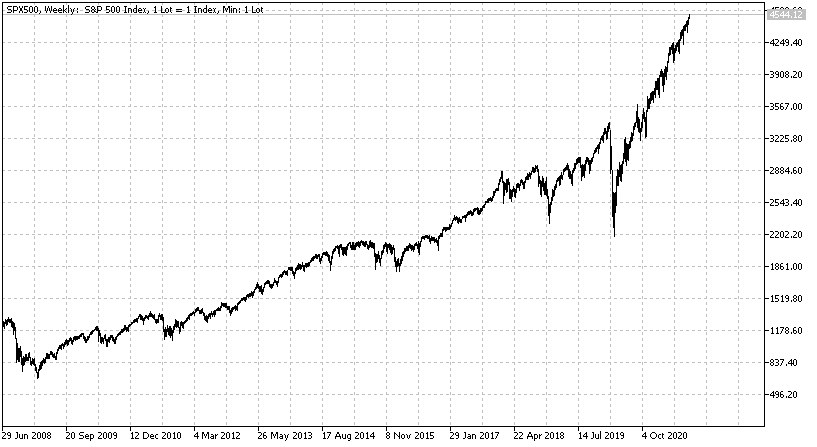

Another very important difference is the long-term movements of the two instruments. Long-term stock movements are usually upward, as we can see from the chart of the S&P 500 index, which includes the 500 largest US companies.

Long-term movements of the currency pairs are characterized by volatility and usually rarely form long-term trends, as can be seen from the EURUSD chart.

2. Types of trading

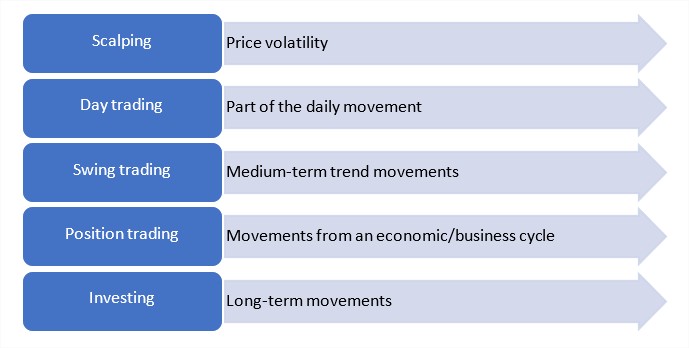

Currencies and stocks allow different types of trading, but the efficiency of securities is greater when it comes to very short or long periods.

Scalping is an appropriate and more successful strategy for trading highly liquid stocks. It is possible to scalp currency pairs, but securities provide some advantages. These are level 2 quotes and real volumes, which is why stock scalping is more effective than currency scalping.

The other extreme, investing, is also much more successful for the equities. It has already been pointed out that long-term stock movements are upward and currencies are volatile. This is the main reason why long-term investments in currencies cannot be a good alternative and do not bring high returns in the long run.

Due to the longer time period in position trading, this style also has higher efficiency for the securities, as the average period for a position is usually around 5 years. If the fundament allows it, similar deals can be concluded on the foreign exchange markets. A good example is the movement of the US dollar against the Turkish lira in recent years.

Day and swing trading, as well as their variants, in which deals are short-term (but not scalping) and medium-term, are more effective in forex trading, as price volatility in foreign exchange markets is greater, which provides more opportunities in both directions.

3. Advantages and disadvantages

The Forex market works 24 hours 5 days a week, which provides more opportunities for traders to make trades. The reason for this working time is that the foreign exchange market is decentralized. This means that there is no specific place where the currencies of the countries are exchanged.

The exchanges on which the shares of the companies are traded have certain working hours, due to which the time window for concluding deals is smaller. If we take as an example the New York Stock Exchange - its working hours are every weekday from 16:30 Bulgarian time to 23:00.

Gaps, which represent a discrepancy between the closing price and the opening price, are another reason that makes forex trading more attractive to traders. As forex is the most liquid market and works 24 hours a day, 5 days a week, the gaps occur much less often and their size is usually small. In foreign exchange trading, a gap can usually occur between Friday and Monday, and the main reasons are political speeches, as well as decisions and reports from economic forums.

The gaps in the shares are far bigger and happen at almost every opening of the stock exchange, ie. almost every day. This significantly increases the risk in stock trading, because in the presence of important news for a company, it is possible the price to open with a big difference compared to the closing price from the previous session. An example of stock gaps can be seen in the Apple chart.

Other advantages and disadvantages are related to the different trading styles, which were explained in the previous point. If we have to summarize them, then scalping, position trading, and long-term investing are more appropriate for stocks. Day trading, swing trading, and their variants can be applied to both the stock and foreign exchange markets, but the foreign exchange market offers more opportunities due to greater price volatility. Position trading in rare cases may also be effective in the forex market, but only if the deals are supported by the fundament.

4. Stocks or Forex?

The choice between trading stocks and currencies depends on both the preferences of each trader and his goals. Most traders are not limited to one asset class, as good opportunities can be found in both the foreign exchange and stock markets.

There are some significant differences between the two asset classes related to their markets that need to be taken into account in order to be able to implement an appropriate strategy and proper risk management.

Currency and stock trading

BenchMark offers more than 70 currency pairs and over 100 stocks from the United States and Europe for online trading. The instruments are offered as CFDs on the MetaTrader platform with a narrow buy/sell spread and real-time quotes.

Currency and stock trading makes it possible to achieve a result both when the price rises (through purchases) and when it becomes cheaper (through short sales) and because they are traded on a margin, trades can be made without having to pay their full value.

| Commissions for trading currencies | NO |

| Commissions for trading stocks | $0.05/share, No min. commissions |

| Spread | from 0.1 pip (currencies); from $0.01 (stocks) |

| Min. trading volume | 1000 currency units (0.01 lot); 1 share (1 lot) |

| Margin requirement | from 0.25% (currencies); from 10% (stocks) |

| Automatic execution | YES |

| Hedging without margin | YES |

| Long/short positions | YES |

| Stop/Limit orders restrictions | NO |

| Expert Advisors | YES, without restrictions |

| Real-time quotes | YES, completely free |

The information provided is not and should not be construed as a recommendation, trade advice, investment research or investment decision consultation, recommendation to follow a particular investment strategy, or be taken as a guarantee for future performance. The content is not consistent with the risk profile, financial capabilities, experience, and knowledge of a particular investor. BenchMark uses public sources of information and is not responsible for the accuracy and completeness of the information, as well as for the period of its relevance after publication. Trading in financial instruments carries risk and can lead to both profits and partial or exceeding losses from the initial investment. For this reason, the client should not invest funds that he cannot afford to lose. This publication has not been prepared in accordance with regulatory requirements aimed at promoting the objectivity and independence of investment research and investment recommendations, is not subject to a ban on transactions in regard to certain financial instruments and/or issuers before its distribution by the person or persons concerned for the investment firm and as such should be perceived as a marketing message.